Office Update – Has Our Ship Come In?

Written on June 20, 2011 at 1:35 pm

One of the best ways to truly get the pulse of the South Florida office market is to sit in a room full of 70 of the top commercial real estate brokers in the area. That is what we do every month with the South Florida Office Brokers Association.

This month’s meeting was at Duke Realty’s Royal Palm Office Park in Plantation. Indianapolis-based Duke, a publicly traded REIT now owns approximately 7 million sf of office and warehouse space in Broward and Palm Beach Counties and has emerged as a dominant player in the local market.

Duke’s Royal Palm in Plantation

Duke’s Royal Palm in Plantation

Although we at Danburg are focused on Boca Raton, the market statistics for Broward and Plantation do provide an excellent indication of what’s happening here in Boca. The numbers themselves can be somewhat dry. I know, I was responsible for creating those numbers throughout the 1980s and 1990s. But an interpretation of those numbers is important as landlords and tenants plot their real estate strategy moving forward.

Some Dry Statistics, but We’ll Get to the Water

According to Jones Lang Lasalle, Broward County will have a positive net absorption of about 59,000 square feet of office space in the second quarter of 2011 after losing about 127,000 square feet in the first qua rter. This would bring market vacancies from 20.2 to 19.9 percent. In Palm Beach County, we absorbed about 84,000 sf in the first quarter and should know shortly about the second quarter. We are seeing some large tenants renewing and expanding, but we are not seeing a whole lot of relocations into the market. A majority of the leasing activity consists of tenants moving from one building to another, a game of musical chairs. (Does anybody really play musical chairs anymore?) Rental rates have remained fairly flat over the past 12 months. New office construction in the market is virtually nonexistent, which will help to hasten the market’s recovery.

rter. This would bring market vacancies from 20.2 to 19.9 percent. In Palm Beach County, we absorbed about 84,000 sf in the first quarter and should know shortly about the second quarter. We are seeing some large tenants renewing and expanding, but we are not seeing a whole lot of relocations into the market. A majority of the leasing activity consists of tenants moving from one building to another, a game of musical chairs. (Does anybody really play musical chairs anymore?) Rental rates have remained fairly flat over the past 12 months. New office construction in the market is virtually nonexistent, which will help to hasten the market’s recovery.

News Flash

It’s not getting a whole lot better, but it has certainly stopped getting worse. We can expect things to slowly improve over the next year to two years. So what does that mean to landlords and tenants ?

As landlords, we realize that there is tremendous competition for quality tenants and everybody is trying to save a buck. We must and we will make aggressive deals to bring quality tenants to our buildings. We believe that once tenants experience our quality of service and our approach to creating a community of businesses, that we can create long lasting mutually beneficial relationships.

I may sound like a broken record (does anybody own records anymore ?) as this is similar to my advice from my August 2010 update, but for tenants, it is a good time to try to lock in today’s low rents for the long term. What has changed slightly is that we expect the turnaround to be a bit more gradual than originally anticipated. We are therefore more likely to enter into longer term leases than we may have been a year ago. But tenants should be careful to find a quality landlord in a quality building that will allow their business to grow over time. This is a win-win situation which saves both sides on transaction costs, moving costs and retrofit.

Is the Water the Key to Getting our Heads Above It?

We are all looking for a sign of something that can jump start our economy and start moving things in a positive direction again. I think we’ll know it when we see it. One real positive in the South Florida Market is the expansion of Port Everglades which is directly related to the expansion of the Panama Canal.

Our guest speaker at SFOBA was Glenn Wiltshire, Deputy Director of Port Everglades. He had some interesting things to say regarding the impact of Port Everglades on the local economy. 3.7 million cruise passengers passed through the Port in 2010, a 17% increase. Cargo revenue was up slightly, which is impressive in light to the downturn in the world economy.

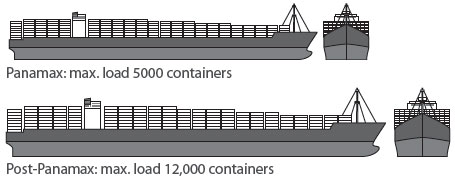

What was most promising through, were his comments on the expansion of both the Port and the Panama Canal. I’m certainly no expert on shipping, but the largest ships able to use the canal today (Panamax) can handle about 5,000 containers of cargo and the Port handles about 800,000 containers per year. In 2014, after the widening, the canal will be able to accommodate ships with up to 12,000 containers (Post Panamax). Plans are underway to expand the channels at the Port to accommodate more ships and larger ships by the latter part of this decade. According to Mr. Wiltshire, this has the potential to bring hundreds of thousands of jobs to Florida. This would certainly stimulate demand for office and industrial space. While this alone may not be the catalyst to jump start our economy, it will certainly contribute and it will be a key factor for us to follow in the coming years.

What was most promising through, were his comments on the expansion of both the Port and the Panama Canal. I’m certainly no expert on shipping, but the largest ships able to use the canal today (Panamax) can handle about 5,000 containers of cargo and the Port handles about 800,000 containers per year. In 2014, after the widening, the canal will be able to accommodate ships with up to 12,000 containers (Post Panamax). Plans are underway to expand the channels at the Port to accommodate more ships and larger ships by the latter part of this decade. According to Mr. Wiltshire, this has the potential to bring hundreds of thousands of jobs to Florida. This would certainly stimulate demand for office and industrial space. While this alone may not be the catalyst to jump start our economy, it will certainly contribute and it will be a key factor for us to follow in the coming years.

A Stern Reminder

A final note from the meeting – Plantation, located in the center of Broward County, has traditionally been one of the area’s strongest office submarkets. But class-A vacancies in Plantation increased from 15 % to 25% due to the collapse of the David Stern Law Firm. The firm, which had occupied 130,000 sf at Royal Palm, was shut down in March for improper handling of approximately 100,000 foreclosure cases. Clearly, the impact of the housing bubble remains with us, but things do finally appear to be heading in a positive direction.

For Office Space and Warehouse in Boca Raton,

Contact Danburg Management at (561) 997-5777

www.danburg.com